Overtime pay: How to ensure wage and hour compliance

by Gabriele Kaier, 18.05.2017

Are your employees classified at the right rates? Are certain employees exempt from overtime? Are the hours being tracked and accounted for correctly? When it comes to overtime pay, there is a variety of regulations that your company has to comply with in order to avoid costly wage and hour disputes. Learn in this article how to avoid getting on the wrong side of the Labor Department.

How to Reduce Overtime Hours

First of all: Overtime hours mean high costs, and research has shown the negative effect of working overtime on employee health and productivity. Below you can find five negative effects of working high levels of overtime, and we reveal how you can solve them.

1. Increased health problems

Several studies have reported an association between long working hours and an increase in lower-back injury, higher blood pressure, mental health problems, overweight, and tobacco and alcohol consumption. A study by Cornell University shows that around about 10% of employees who work 50 to 60 hours per week suffer from work-family conflicts. This rate jumps to 30% for those who work more than 60 hours. The divorce rate increases as weekly hours increase. These factors give rise to mental health and alcohol problems. A Canadian study showed that workers who increased their work hours from 40 hours or less per week to over 40 hours per week experienced an increase in tobacco and alcohol consumption, an unhealthy weight increase among men, and an increase in depression among women. On the other side, indirect costs such as health care costs, and absenteeism are rising, while productivity decreases.

2. Increased safety risk

Several studies show that long working hours can be linked to increased safety risk and working errors or workers’ accumulated fatigue. After 16 hours at work, accident rates triple. Companies with shift work operations and with more fatigue-related problems have also higher rates of overtime. Longer working hours also effect sleep quantity and quality.

3. Less productivity

Studies showed that productivity decreased by working overtime hours. White-collar employees who work 60 or more hours in a week have 25% lower performance than expected. Hence, fatigue slows down work rates and productivity decreases. Employees suffer from work-family imbalance and health problems.They are physically at work, but they lack of concentration.

4. Increased absenteeism

Poor health, fatigue, or people simply needing time off can lead to absenteeism. If employees are absent, they have to be replaced by other employees who often work overtime themselves, which makes the problem self-perpetuating. Morale is also reflected in absenteeism: Shift operating companies with very high overtime levels have at the same time very poor morale.

5. Worse turnover rates

On one side, decreased turnover is a consequence of excessive absenteeism. On the other side, absenteeism causes high overtime, as the work of absent employees has to be filled up if demand is to be met.

Ensure Wage and Hour Compliance

When it comes to overtime pay, there are a variety of regulations that your company has to comply with in order to avoid costly wage and hour disputes. These are mostly employment law disputes, which involve the amount of wages an employee is paid or the number of hours he has worked. And in some cases disputes can involve a class action lawsuit.

To get a better picture, the Wage and Hour Division (WHD) published the following statistics on enforcement for 2016:- Back Wages: $266,566,178

- Employees Receiving Back Wages: 283,677

- Complaints Registered: 20,522

- Enforcement Hours: 1,112,939

- Average Days to Resolve Complaint: 121

- Concluded Cases: 28,589

Following important questions have to be answered in the context of overtime pay:

- Are your employees classified at the right rates?

- How many hours has the employee worked?

- Is the person entitled to overtime pay?

- Are certain employees exempt from overtime?

- Are the hours being tracked and accounted for correctly?

The Fair Labor Standards Act (FLSA) issued by the United States` Department of Labor requires overtime pay for hours worked in excess of 40 hours in a workweek. Working on weekends or nights is a matter of agreement between the employer and the employee. The FLSA does not require extra pay for weekend or night work.

How to Avoid Getting on the Wrong Side of the Labor Department?

Assess your situation, find out if your existing time tracking system sets rules which ensure that each worker is classified correctly and overtime is accounted for accurately.

A helpful time and attendance system lets you easily:

- Apply federal and company´s policies to ensure each worker’s overtime is accounted for correctly

- View employee hours in real-time

- Generate reports per employee

- Integrate the time and attendance data into payroll and other systems

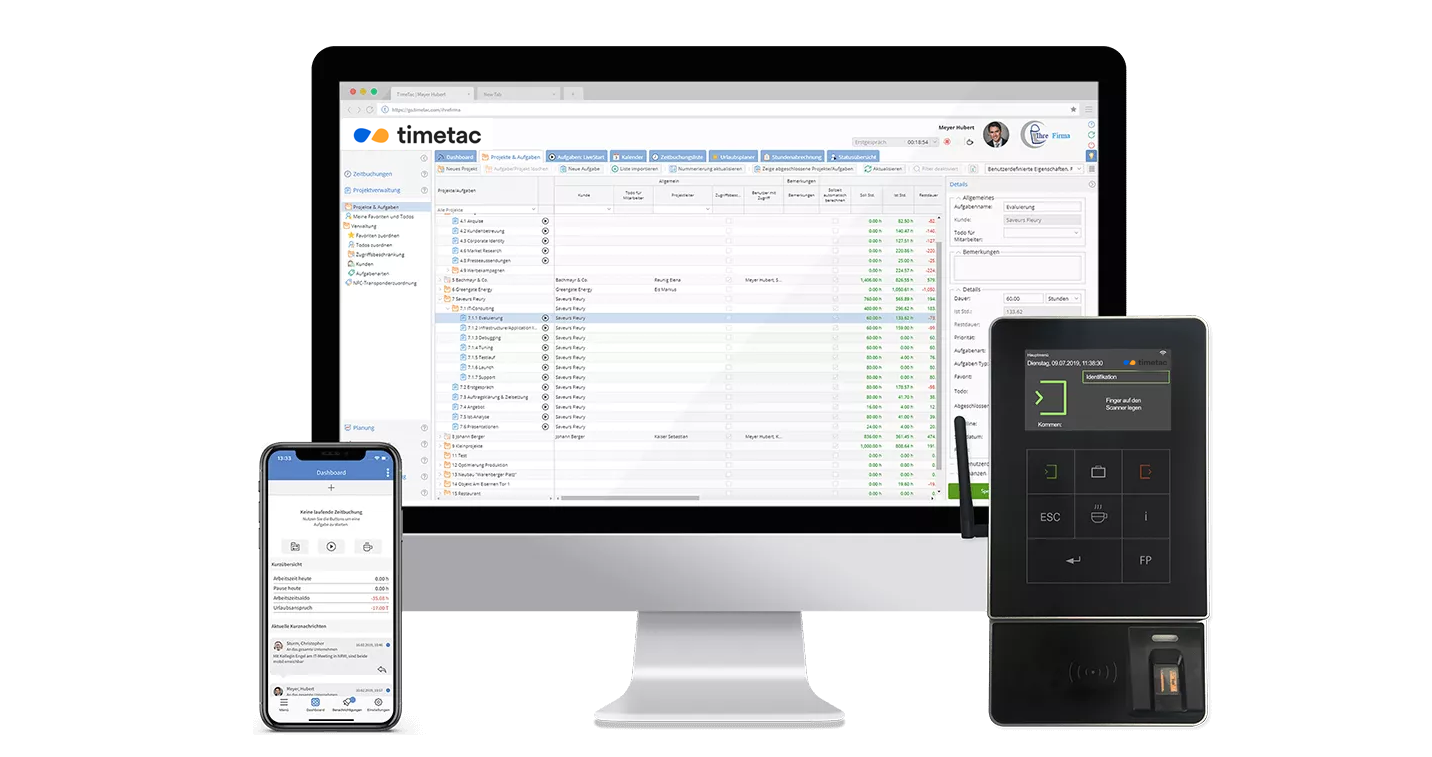

Keeping Track of All the Overtime Hours

Check out which extremely useful features the right time and attendance software can offer

Jahresabschluss leicht gemacht!

Kontaktieren Sie uns!Sie möchten mehr über die Stundenabrechnung mit TimeTac erfahren? Wir freuen uns über Ihre Anfrage!